In this fourth episode of my video blog, I explain the economic slowdown, why central banks are not understanding the key global trends and what they mean for inflation, growth and productivity.

Do not miss the other episodes. Thanks for watching!!

Third Episode of my video-blog World Economics. Thanks for the success of the other episodes. This month we speak of the global slowdown and the poisoned solution of more stimuli and “a new deal”

What happens when politicians see that their monster stimuli have not delivered? They bring the next rabbit out of a hat. They need a new name and a new magic solution to make citizens believe in the magic of demand-side policies despite the constant failure of those same plans. Read More

Talking in CNBC about the 2019 outlook

The central idea is that we are in the process of a change of cycle that central banks and governments are unlikely to disguise because both monetary tools and fiscal space have been exhausted. This change of cycle may not lead to a 2008-style recession, but more likely to a Japanese-style stagnation as debt continues to rise while economic and productivity growth weaken. As such, we as investors may believe the mirage of a chain of “bullish” headlines in the first part of 2019: a trade deal between the U.S. and China (likely), a large China stimulus (very likely) and central banks’ relative dovishness (highly likely). This may create short-term bounces, but the euphoria effect many quickly fade because even with a bounce in global liquidity, net financing needs may exceed real growth. If markets react quickly and aggressively to these “false” bullish signals increasing risk and leverage, the probability of falling into a 2008-style crisis increases. Liquidity is falling, and this may reduce this risk of abnormal bullishness.

- Eurozone slowdown worsens. After a moderate slowdown in 2018, the Eurozone economy is likely to enter a period of stagnation as France, Italy, Germany and Spain post weaker growth figures than expected. The likely rise in bond yields may also affect credit growth. Governments have completely abandoned any reform agenda and the rise in public spending combined with lower tax revenues and growth might erode the confidence in the solvency of the Eurozone major economies. Brexit is likely to be a minor factor in this slowdown. The largest impact is probably going to come from weakening consumption and industrial output. Weak commodity prices may help the Eurozone avoid a recession, but credit risks will probably intensify as the effect of ECB purchases ends and political unrest rises.

- Brexit impact becomes negligible on the UK economy. The process of exit from the EU is unlikely to create the doomsday scenario announced by many as the dynamism of the exporting industry, the strength of the labour market and the comparatively attractive taxation versus global peers generate a better growth environment for the UK.

- Commodities rebound only to fall again on China failed stimulus. There will likely be a trade agreement between China and the U.S. that may help energy commodities as well as base and industrial metals short-term. However, markets focusing on this trade agreement catalyst are likely to be disappointed into the end of the year as the evidence of debt saturation and structural factors behind the economic slowdown of China become more evident. The headlines of a massive stimulus and a trade agreement will probably drive growth estimates to overoptimistic levels that may need significant downgrades as the reality of disinflation and global slowdown becomes more apparent.

- Gold rises as liquidity dries up and currencies weaken. Emerging market concerns are likely to rise again as the recent calm is tested by large U.S. dollar denominated maturities. Emerging economies have increased their imbalances—both fiscal and trade deficits in many countries—throughout 2018. There is very little that most governments want to do to avoid the increasingly demanding net financing needs. As the optimism about growth and Federal Reserve dovishness fades, we are likely to see the central banks of most emerging economies letting their currencies devalue in order to maintain foreign exchange reserves.

- U.S. economy avoids recession but slows down. The government shutdown will not generate a massive impact on the economy, and steady flow of capital into the U.S. economy is likely to drive a moderate slowdown that avoids recession thanks to a stronger and more dynamic economy than the European, Japanese and Chinese. Low oil prices and a strong dollar are needed to avoid recession. If the Fed capitulates and halts the announced rate hikes, we might see a temporary bounce in risky assets and investors retrying the reflation trade, but only to see another year of two halves where flight to U.S. assets is likely to accelerate once investors find that the headlines of trade agreement, Fed dovishness and Chinese stimulus are not as bullish in terms of growth and global demand as needed to keep the U.S. dollar carry trade ongoing.

- The biggest positive scenario for 2019 would be that central banks maintain their promises of normalization and the economies gradually strengthen driven by savings and productive investment.

- The biggest negative scenario for 2019 is that economies believe that 2018 was an anomaly and fall into the trap of believing, like in 2008, that a China stimulus will prevent the change of cycle.

Qatar withdrawal from #OPEC is a monumental event that signals the likely end of the cartel. Watch my interview at @WIONews India

The G20 meeting in Buenos Aires had a primary objective. To reach an agreement between the United States and China.

However, the announced agreement is more a “diplomatic truce” than a real agreement.

The United States commits to delaying tariffs against China that would start on January 1st, 2019 and China commits to purchase more agricultural and energy products (LNG, liquefied natural gas) in addition to promising to advance in legal security, compliance with contracts, the opening of capital markets and protection of intellectual property.

However, the wording is vague, the commitments are conditional and the time is limited.

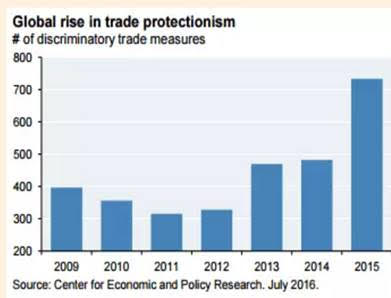

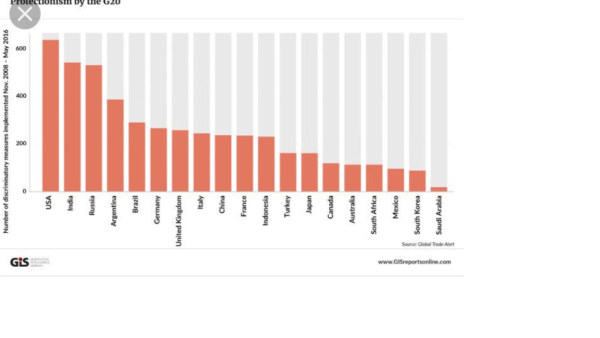

When we talk about trade wars as if they were something new, we make a diagnosis mistake. We’ve been in a trade war for years. The United States has been denouncing trade barriers imposed by China and other countries directly and indirectly for years, with a World Trade Organization that did nothing about it.

The United States acted in the wrong way, and between 2009 and 2016 introduced more protectionist measures than any other G-20 country. The World Trade Organization warned on several occasions before the Trump administration took office of the increase in protectionism since 2011.

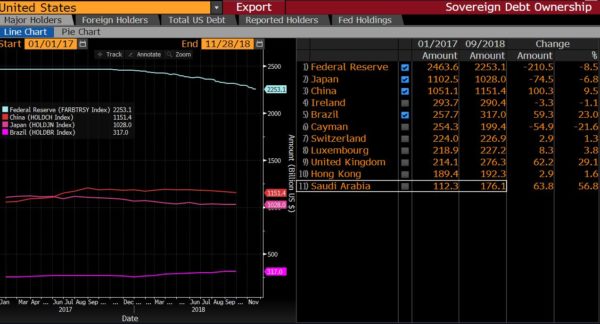

China desperately needs to keep the trade surplus with the United States to maintain its extremely indebted growth model. More than the United States needs China to purchase its debt.

China is not the main holder of US bonds (not even the largest foreign buyer). The largest holders are North American institutions and investors in their vast majority.

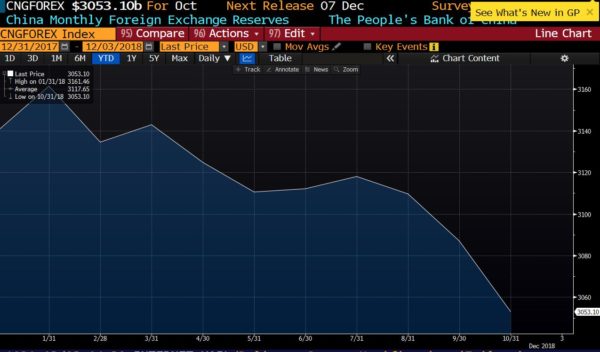

The United States has seen demand for its bonds remain robust and yields have not soared even with China and the Fed selling. Meanwhile, China’s foreign exchange reserves have fallen.

China’s foreign currency reserves fell to the lowest level in 18 months in October. A reduction of $ 33.9 billion in October, the worst since December 2016 and the lowest level since April 2017.

China cannot maintain its growth – based on a huge debt bubble – if its exports to the US fall. There is no other market that can offset its exports to North America. And its trade surplus with the United States is already over 275 billion dollars per year, the biggest contributor to the Chinese GDP from the external sector.

A drop in the growth of China’s exports would mean a much larger collapse of its foreign exchange reserves, which are down 30% since the 2014 highs.

A collapse in foreign exchange reserves also accentuates the already existing capital flights, which in turn would lead to more capital controls and, with it, three effects. Lower growth, an increase in the already high debt and the risk of a very important devaluation of the yuan.

These three effects have already happened in 2018.

In summary, for China, the trade war is devastating. For the US it is negative, but for China it is a disaster.

The United States exports very little (11% of GDP), so any threat that leads to an agreement is good.

A trade war can generate higher costs of goods and services for Americans, but the reality is that China exports disinflation and, if any, inflation expectations are falling, not rising.

This does not mean I support trade wars. It means that the idea that both sides are equally negatively impacted is simply empirically incorrect.

As such, the agreement announced between the US and China in the G20 is nothing more than a “conditional ceasefire”.

China has little intention of guaranteeing intellectual property and eliminating capital controls or the immense interference between political and legal power.

The increase in purchases from China to the United States announced is likely to have a very low impact on the trade surplus . China’s trade surplus with the US has skyrocketed in 2018 from 21.9 billion dollars in January to 34.1 billion in September. If China doubles its purchases of agricultural and energy products from the United States, something very difficult to achieve, this surplus would only fall by a maximum figure of 3 billion US dollars.

This agreement is only a pause, and the announced tariffs would be recovered if improvements are not evident. The tariffs announced for January 1st would be increased to 25% if China does not comply in 90 days.

The differences in the interpretation of the agreement between the Chinese and US administrations can be seen in their official statements.

While the US says that China will change its policy with respect to intellectual property, capital control and legal security, China only says that they “will work together”. While the US states that the agreement is invalidated after 90 days, China does not mention the deadline. While the US mentions that the purchases of North American products will increase in specific sectors, China only talks about buying more products.

This agreement does not change the trade and policy differences of both countries, but it is very similar to the failed agreement reached with China in May that ended in nothing. We have to be very cautious and wait to see if real economic data improves. If China continues to devalue the Yuan and inject capital into its financial and corporate sectors it will be a sign that the agreement has no credibility for the Chinese government itself. Furthermore, as leading indicators show, the global slowdown is much deeper and complex than the differences between China and the US on trade. If the global economy recovered the trade growth levels of 201, global GDP slowdown would still be evident, and more pronounced than consensus currently estimates.

This trade deal is not only vague, conditional and temporary… It does not disguise the slowdown of major economies, which had nothing to do with trade wars and a lot to do with debt saturation.

Be careful thinking that this is a catalyst that puts the world back in growth and multiple expansion modes. The reality is that this deal is not a catalyst for the global economy.

In this chat at IG TV we discuss the outlook for copper and other base metals.

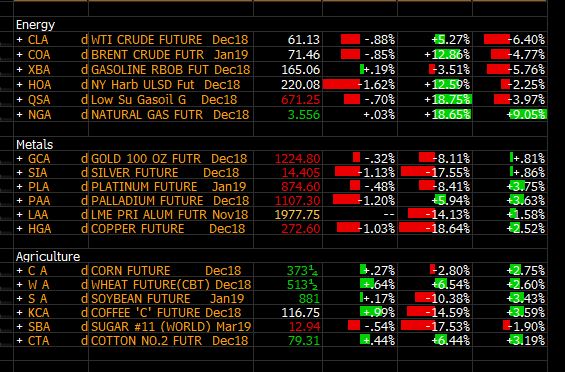

Oil prices surged into the third quarter due to a combination of factors:

- Artificial supply manipulation, as OPEC maintained production cuts despite healthy demand and better inventories. We discussed it here.

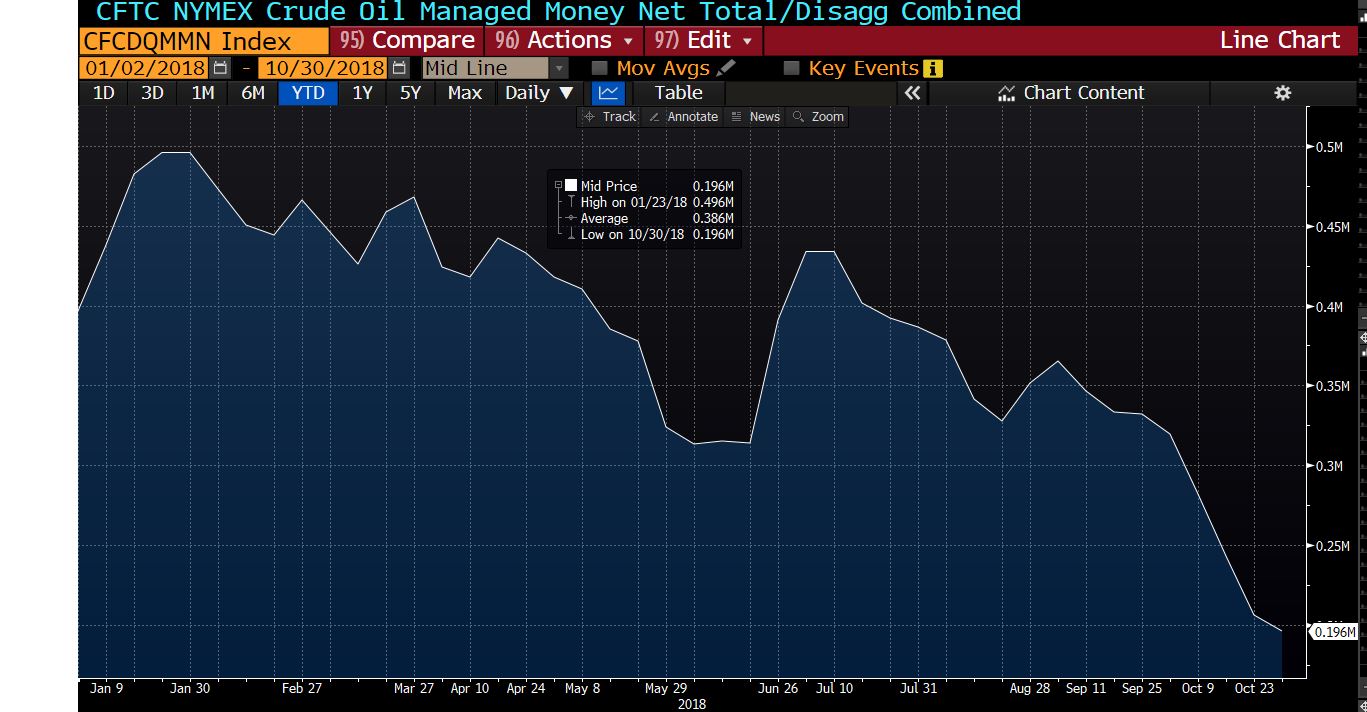

- Strong leveraged buying based on reflation expectations. As the graph below shows, net length in crude oil rose significantly, only to fall abruptly as rates rise.

- Excessively optimistic demand growth estimates. In the past three months, we have seen demand estimates slashed by brokers who, at the same time, kept bullish estimates of oil prices into 2019.

Now we are seeing an obvious “hangover” effect, similar to what we saw in 2008.

If you remember, in 2008 we saw oil prices rise dramatically despite global growth estimates coming down and evidence of rising risks to the global economy. We might not be in a similar situation to 2008, but we are seeing a clear evidence of a slowdown.

Moody’s has slashed its estimates of global growth for 2019 by 10% in the past three months, to 3%. Meanwhile, crude inventories are likely to rise in the next months as the main importers start to show the reality of lower growth.

The US has reached an all-time record in oil production, 11.6 million barrels per day, and expected to reach 12 million barrels per day in the next two years, surpassing Russia and Saudi Arabia as the world’s largest producer.

As such, oil prices have roundtripped despite OPEC keeping the tight grip on supply, and also despite concerns on Venezuela and Iran output.

Not only short-term prices are down on the year, but the entire long-term curve has shifted down.

We are talking an entire $5 move down in the forward curve, and oil is now in contango, after spending a few months in backwardation.

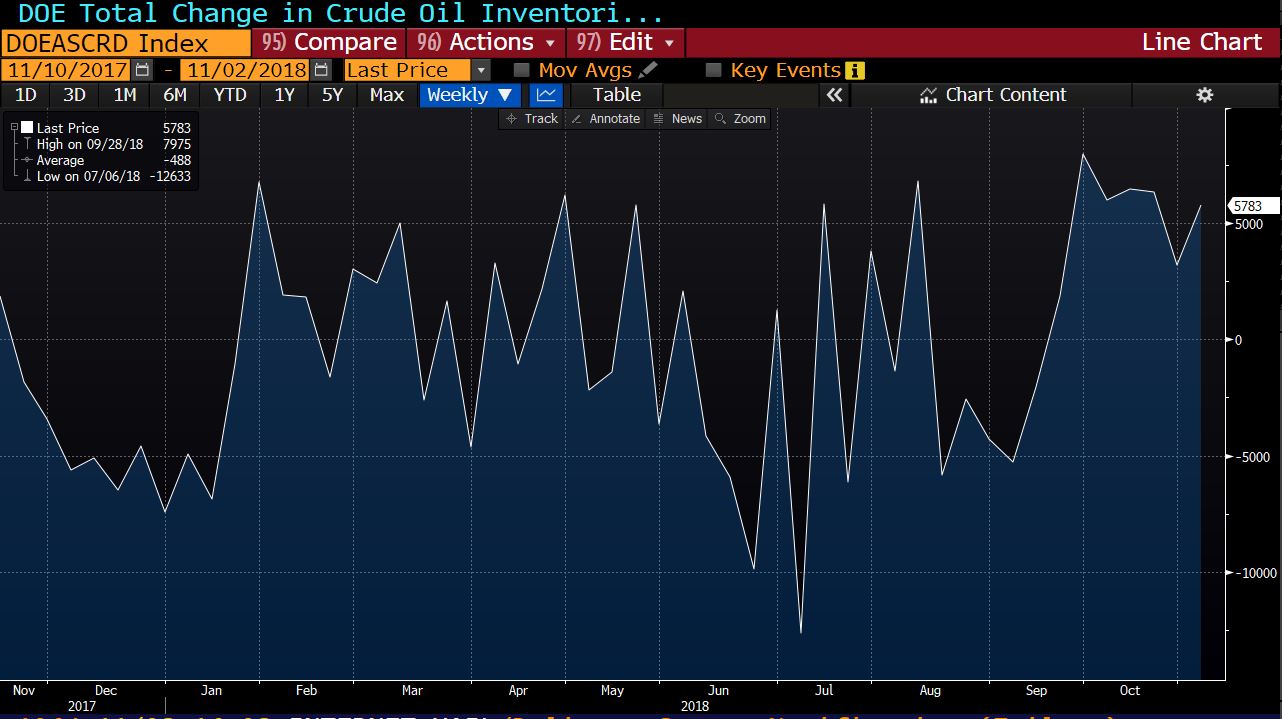

Inventories, which fell between April and September, are back at high levels.

The move in oil is simply another piece of evidence of the global slowdown that had been reflected in the price of copper and other commodities. More disinflationary risk as Chinese data becomes more concerning and the eurozone, as well as emerging markets, publish weaker-than-expected figures.

We cannot blame the US dollar, because oil prices have been falling without any rise in the DXY (dollar index).

OPEC has kept its supply cuts, so there is very little else they can do. More importantly, if they decide to artificially manipulate supply again, the response from consumers will be more diversification and it will be -again- only to the advantage of the US producers.

Furthermore, if OPEC remains fixated in inflating oil prices, they will simply hurt their customers in a weakening global growth environment.

What oil prices are showing is simply that we were living a mirage of bullish estimates and artificial inflation of prices, and it lasted very little.

If you want to be bullish oil from here you need to believe in three things:

. OPEC greed (probable)

. Global demand growth rising (improbable)

. Rates falling and leveraged bets increasing (unlikely)

The reflation trade never existed. It was simply part of the fallacy of synchronized growth, and it is dissipating alongside the central-planned myth of GDP growth by design.

We have been reading numerous comments recently about a forthcoming recession and the next crisis, particularly on the tenth anniversary of the collapse of Lehman Brothers.

The question is not whether there will be a crisis, but when. In the past fifty years, we have seen more than eight global crises and many more local ones, so the likelihood of another one is quite high. Not just because of the years passed since the 2007 crisis, but because the factors that drive a global crisis are all lining up.

What drives a financial crisis? Three factors.

- Demand-side policies that lead investors and citizens to believe that there is no risk. Complacency and excess risk-taking cannot happen without the existence of a widespread belief that there is some safety net, a government or central bank cushion that will support risky assets. Terms like “search for yield” and “financial repression” come precisely from artificial demand signals created from monetary and political forces.

- Excessive risk-taking in assets that are perceived as risk-free or bullet-proof. It is impossible to build a bubble on an asset where investors and companies see an extraordinary risk. It must happen under the belief that there is no risk attached to rising valuations because “this time is different”, “fundamentals have changed” or “there is a new paradigm”, sentences we have all hears more times than we should in the past years.

- The realization that this time is not different. Bubbles do not burst because of one catalyst, as we are told to believe. The 2007-2008 did not start because of Lehman, it was just a symptom of a much wider problem that had started to burst in small doses months before. Excess leverage to a growth cycle that fails to materialize as the consensus expected.

What are the main factors that could trigger the next financial crisis?

- Sovereign Debt. The riskiest asset today is sovereign bonds at abnormally low yields, compressed by central bank policies. With $6.5 trillion in negative-yielding bonds, the nominal and real losses in pension funds will likely be added to the losses in other asset classes.

- Incorrect perception of liquidity and VaR (Value at Risk). Years of high asset correlation and synchronized bubble led by sovereign debt have led investors to believe that there is always a massive amount of liquidity waiting to buy the dips to catch the rally. This is simply a myth. That “massive liquidity” is just leverage and when margin calls and losses start to appear in different areas -emerging markets, European equities, US tech stocks- the liquidity that most investors count on to continue to fuel the rally simply vanishes. Why? Because VaR (value at risk) is also incorrectly calculated. When assets reach an abnormal level of correlation and volatility is dampened due to massive central bank asset purchases, the analysis of risk and probable losses is simply ineffective, because when markets fall they fall in tandem, as we are seeing these days, and the historical analysis of losses is contaminated by the massive impact of monetary policy actions in those years. When the biggest driver of asset price inflation, central banks, starts to unwind or simply becomes part of the expected liquidity -like in Japan-, the placebo effect of monetary policy on risky assets vanishes. And losses pile up.

The fallacy of synchronized growth triggered the beginning of what could lead to the next recession. A generalized belief that monetary policy had been very effective, growth was robust and generalized, and debt increases where just a collateral damage but not a global concern. And with the fallacy of synchronised growth came the excess complacency and the acceleration of imbalances. The 2007 crisis erupted because in 2005 and 2006 even the most prudent investors gave up and surrendered to the rising-market beta chase. In 2017 it was accelerated by the incorrect belief that emerging markets were fine because their stocks and bonds were soaring despite the Federal reserve normalization.

What will the next crisis look like?

Nothing like the last one, in my opinion. Contagion is much more difficult because there have been some lessons learnt from the Lehman crisis. There are stronger mechanisms to avoid a widespread domino effect in the banking system.

When the biggest bubble is sovereign debt the crisis we face is not one of the massive financial market losses and real economy contagion, but a slow fall in asset prices, as we are seeing, and global stagnation.

The next crisis is not likely to be another Lehman, but another Japan, a widespread zombification of global economies to avoid the pain of a large re-pricing of sovereign bonds, that leads to massive tax hikes to pay the rising interests, economic recession and unemployment.

The risks are obviously difficult to analyse because the world entered into the biggest monetary experiment in history with no understanding of the side effects and real risks attached. Governments and central banks saw rising markets above fundamental levels and record levels of debt as collateral damages, small but acceptable problems in the quest for a synchronised growth that was never going to happen.

The next crisis, like the 2007-08 one, will be blamed on a symptom (Lehman in that case), not the real cause (aggressive monetary policy incentivising risk-taking and penalising prudence). The next crisis, however, will find central banks with almost no real tools to disguise structural problems with liquidity, and no fiscal space in a world where most economies are running fiscal deficits for the tenth consecutive year and global debt is at all-time highs.

When will it happen? We do not know, but if the warning signs of 2018 are not taken seriously, it will likely occur earlier than expected. But the governments and central banks will not blame themselves, they will present themselves -again- as the solution.