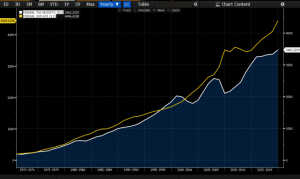

Every time there is a budget debate, politicians from both parties will discuss the deficit and spending as if the first one did not matter and the latter could only increase. However, the main problem of the US budget in the past four decades is that total outlays rise significantly faster than receipts no matter what the economic growth or revenue stream does. For example, in the fiscal years 2018 and 2019 total outlays rose mostly due to mandatory expenses in Social Security, Medicare, and Medicaid. No tax revenue measure would have covered that amount.

Total outlays were $4,447 billion in 2019, $339 billion above those in FY 2018, an 8.2 percent increase. No serious economist can believe that any tax increase would have generated more than $300 billion of new and additional revenues every year.

The idea that eliminating the tax cuts would have solved the deficit is clearly debunked by history and mathematics. There is no way in which any form of revenue measure would have covered a $339 billion spending increase.

No serious economist can believe that keeping uncompetitive tax rates well above the average of the OECD would have generated more revenues in a global slowdown. If anything, a combination of higher taxes and weaker growth would have made the deficit even worse. Why do we know that? Because it is exactly what has happened in the Eurozone countries that decided to raise taxes in a slowdown and it is also what all of us witnessed in the United States when revenue measures were implemented.

The US was maintaining a completely uncompetitive and disproportionately high corporate income tax (one of the highest in the world) and all it did was to make it similar to other countries (the Nordic countries have corporate income tax rates of 21.4% Sweden and 22% Denmark, for example).

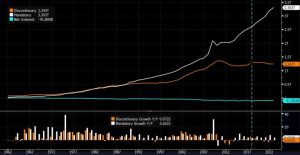

What happened to corporate tax receipts before the tax cut? The evidence of a weakening operating profit environment: Corporate tax receipts fell 1% in 2017 and 13% in 2016. The manufacturing and operating profit recessions were already evident before the tax cuts. If anything, reducing the corporate rate helped companies hire more and recover, which in turn made total fiscal revenues rise by $13 billion to $3,328 billion in the fiscal year 2018, and rise by $133 billion in 2019, to $ 3,462 billion, both above budget, according to the CBO. Remember also that critics of the tax cuts expected total receipts to fall, not increase.

Mandatory spending is now at $2 trillion of a total of $4.45 trillion outlays for the fiscal year 2019. This figure is projected to increase to $3.3 trillion by 2023. Even if discretionary spending stays flat, total outlays are estimated to increase by more than $1 trillion, significantly above any measure of tax revenues, and that is without considering a possible recession.

Any politician should understand that it is simply impossible to collect an additional $1 trillion per year over and above what are already record-high receipts.

For 2020, tax receipts are estimated at $3,472 billion compared to $4,473 billion in outlays, which means a $1,001 billion deficit. With outlays consistently above 20% of GDP and receipts at 16.5% average, anyone can understand that any recession will bring the gap wider and deficits even higher.

Deficits mean more taxes or more inflation in the future. Both hurt the middle class the most. More government spending means more deficit, more debt, and less growth.

When candidates promise more “real money” for higher spending they are not talking of real money. They talk of real debt, which means less real money into future schools, future housing, and future healthcare at the expense of our grandchildren’s salaries and wealth. More government and more debt is less prosperity.

Anyone who thinks that this gap can be reduced by massively hiking taxes is not understanding the US economy and the global situation. It would lead to job destruction, corporate relocation to other countries and lower investment. However, even in the most optimistic estimates of tax revenues coming from some politicians, the revenue-spending gap is not even closed, let alone a net reduction in debt. The proof that the US problem is a spending issue is that even those who propose massive tax hikes are not expecting to eliminate the deficit, let alone reduce debt, that is why they add massive money printing to their magic solutions.

Now, let us ask ourselves one question: If the solution to the US debt and deficit is to print masses of money, why do they propose to increase taxes? If printing money was the solution, the Democrats should have massive tax cuts in their program. The reality is that neither tax hikes nor monetary insanity will curb the deficit trend.

No tax hike will solve the deficit problem. Even less when those tax hikes are supposed to finance even more expenses. No amount of money printing will solve the financial imbalances of the US, it only increases the problem. If money printing was the solution, Argentina would be the highest growing economy in the world.

If the US wants to curb its debt before it generates a Eurozone-type crisis that leads to stagnation and high unemployment, the government needs to really cut spending, because deficits are soaring due to ballooning mandatory outlays, not due to tax cuts.