The U.S. federal government published a December deficit of $129 billion, up 52% from the previous year. The private sector recession is clear as expenses continue to rise while tax receipts decline. If we look at the period between October and December 2023, the deficit ballooned to a staggering $510 billion.

You may remember that the Biden administration expected a significant deficit reduction from its tax increases and the expected benefits of its Inflation Reduction Act.

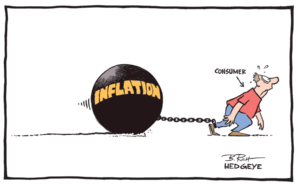

What Americans got was a massive deficit and persistent inflation. According to Moody’s chief economist, Mark Zendi, the entire disinflation process seen in the past years comes from exogenous factors such as “fading fallout from the global pandemic on global supply chains and labor markets, and the Russian War in Ukraine and the impact on oil, food, and other commodity prices.” The complete disinflation trend follows the slump in money supply (M2), but the Consumer Price Index (CPI) should have fallen faster if deficit spending, which means more consumption of newly created currency, would have been under control. December was disappointing and higher than it should have been.

The United States annual CPI (+3.4%) came above estimates, proving that the recent bounce in money supply and rising deficit spending continue to erode the purchasing power of the currency and that the base effect generated too much optimism in the past two prints. Most prices rose in December, and only four items fell. In fact, despite a large decline in energy prices, annual services (+5.3%), shelter (+6.2%), and transportation services (+9.7%) continue to show the extent of the inflation problem

The massive deficit means more taxes, more inflation, and lower growth in the future.

The Congressional Budget Office (CBO) expects an unsustainable path that still leaves a 5.0% deficit by 2027, growing every year to reach a massive 10.0% of GDP in 2053 due to a much faster growth in spending than in revenues. The enormous increase in debt will also lead to extremely poor growth, with real GDP rising much slower throughout the 2023–2053 period than it has, on average, “over the past 30 years.”

Deficits are not a tool for growth; they are tools for stagnation.

Deficits mean that the currency’s purchasing power will continue to vanish with money printing and that the real disposable income of Americans will be demolished with a combination of higher taxes and a weaker real value of their wages and deposit savings.

We must remember that, in Biden’s administration’s own estimates, the accumulated deficit will reach $14 trillion in the period to 2032.

This unsustainable level of fiscal irresponsibility will also lead to more massive money printing. The Federal Reserve will have to lead with larger federal fiscal imbalances than seen in crisis times, even considering estimates that assume no recession or crisis. So, if a crisis hits, the situation will simply explode.

Article originally published in Tomorrow’s Affairs

As we embark on the year 2024, the economic landscape is characterized by a blend of factors, including declining but still elevated inflation, potential interest rate cuts, increasing geopolitical risks, and soaring public debt.

The final quarter of 2023 witnessed a remarkable improvement in market sentiment. The moderation of inflation, strong corporate profits that exceeded expectations, and optimism regarding impending rate cuts all contributed to this surge.

The heightened complacency, evident in the “extreme greed” levels on the CNN Greed and Fear Index, resulted from aggressive rate reduction expectations by central banks and projections of a swift decline in inflation. However, as we move into 2024, parallels with the preceding year become apparent.

Contrary to market expectations, a “soft landing” is not enough to bring about the anticipated year of disinflation; a recession is the necessary catalyst.

An abrupt increase in the global money supply, standing at nearly $107 trillion by the end of the year, remained a bulwark against a recession in 2023, coupled with relentless government spending.

A lag effect

The contrast between alleged tight monetary policy and active fiscal measures has placed the entire negative impact on the private sector, bearing the brunt of rate hikes and declining monetary aggregates.

A manufacturing sector that remains in deep contraction is joined by a services sector that sees how consumers have almost depleted their savings for 2021.

Although inflation declined alongside monetary aggregates, the economic repercussions have been delayed due to a lag effect.

The full-scale impact of the 2023 monetary contraction is expected to manifest in 2024

The full-scale impact of the 2023 monetary contraction is expected to manifest in 2024, leading to a decline in inflation if the economy falters and private sector demand recedes.

However, the notion of a quick slump in inflation with no impact on growth or jobs appears increasingly implausible. Additionally, a looser monetary policy may contribute to commodities rebounding, attracting freshly printed money towards unconventional assets, and making the inflation decline more challenging.

The impact of debt and public spending remains a critical consideration. Will central banks uphold market support? How will taxes and macroeconomic factors shape the global economy? These questions underscore the delicate balance between recovery and potential risks.

A year of stagnation

In 2024, a prudent investment policy is recommended. Central banks are expected to maintain accommodative policies, injecting liquidity selectively. However, anticipated interest rate reductions may not be as significant as expected.

The global economy enters 2024 with less uncertainty. Geopolitical risks seem to have been discounted, and this may be a sign of excessive optimism in a year where global growth is projected to slow markedly, while the Eurozone and Latin America may continue to show worse growth than their counterparts.

2024 will likely be a year of stagnation with elevated public debt

Strong China and India growth will not likely change the weak trend of productivity and growth generated in most developed and emerging economies after years of debt-fueled government spending programs.

2024 will likely be a year of stagnation with elevated public debt. Thus, the expected quantitative tightening is likely to be less severe with a rising global money supply and improved credit conditions.

A risky environment for fiat currencies is anticipated, with ongoing destruction of the purchasing power of the domestic currencies as governments continue to increase their fiscal imbalances.

Gold and bitcoin may help citizens avoid the debasement of currencies without ignoring the large difference in volatility of each asset class.

Global loss of purchasing power is likely to continue even with declining annual rates of rise in consumer prices, with expected global inflation between 3.5% and 4%

Expectations of large rate cuts and even quantitative easing from the Federal Reserve may be too optimistic. In a U.S. election year, substantial changes in monetary policy are not anticipated.

As such, global demand for dollars is expected to rise, creating a favorable environment for dollar-denominated assets.

Numerous risks cast shadows on the economic horizon, including more persistent inflation, unanticipated impacts on business margin and profits, potential currency depreciation in emerging markets, the ongoing China-USA trade conflict, the war in Ukraine and Israel generating widespread geopolitical risk, and the spectre of a black swan event in the debt market causing a credit crunch.

2024 is likely to be very similar to 2023. The long-term trends of weak productivity and GDP growth, high debt, rising government size in major economies, increases in taxes, and erosion of the purchasing power of salaries and savings will continue.

Equities may react positively to looser monetary policy, but the macroeconomic path to stagnation remains.

Latin America Faces Another Lost Decade. Socialist populism is making the region lag peers.

Fox News: My interview in Making Money with the great Charles Payne

Milei must now confront this poisoned legacy with determination and courage. Macri, who suffered from the error of gradualism, recently argued that there was no room for mild measures, and he is right.

Milei has promised to shut down the central bank and dollarize the economy. However, can it be accomplished?

The answer is yes. Absolutely.

To understand why Argentina must dollarize, the reader must know that the peso is a failed currency that even Argentine citizens reject. Most Argentine citizens already save what they can in US dollars and conduct all major transactions in the US currency, because they know that their local currency will be dissolved by government interventionism. The government has 15 different exchange rates for the peso, all fake, of course, all of which have only one objective: to steal from citizens their US dollars at a fake exchange rate.

The central bank is bankrupt, with negative net reserves, and the peso is a failed currency. Therefore, shutting down the central bank is essential, and the country needs to have an independent regulator without the power to print currency and monetize all the fiscal deficit, and it must eliminate the possibility of issuing the insane Leliq (remunerated debt) that destroys the currency today and in the future.

Shutting down the central bank requires an immediate and strong solution to the Leliqs, which will have to include a realistic approach to the monetary mismatch in a country where the “official exchange rate” is half the real market rate against the US dollar. Taking a bold step to recognize this monetary mismatch, closing the central bank, and ending the monetization of debt are three essential steps to end a path to the destruction of a country comparable to that of Venezuela. Milei understands this and knows that the US dollars that citizens save with enormous difficulty should flow back to the domestic economy by recognizing the monetary reality of the country making the US dollar a legal tender for all transactions.

The monetary issue is one side of a hugely problematic coin. The fiscal problem needs to be addressed. Milei needs to put an end to the bloated fiscal deficit, and that requires an adjustment that eliminates political spending without destroying pensions. This must involve selling some of the many inefficient and bloated public companies and the excess spending in purely political subsidies. Secondly, Milei must put an end to the ridiculous trade deficit. Argentina must slash the misguided protectionist and interventionist laws if the Peronists are open to the world to export all they can. To do this, it needs to put an end to the ridiculous “currency exchange rate clamp” and the 15 false exchange rates that the government uses to expropriate dollars from citizens and exporters with unfair rates and confiscations.

Taxes need to be lowered in a country that has 165 taxes and the highest tax wedge in the region, where small and medium-sized enterprises pay up to 100% of their sales.

Argentina must change what is currently a confiscatory and predatory state. Additionally, bureaucratic barriers, protectionist measures, and political subsidies must be removed. Furthermore, Milei must ensure legal certainty and an attractive and reliable regulatory framework where the ghost of expropriation and institutional theft does not return.

Milei’s challenges are many, and the opposition will try to sabotage all market-friendly reforms because many politicians in Argentina became very powerful and rich turning the country into a new Venezuela.

If Argentina wants to become a thriving economy that returns to prosperity, it needs a stable macroeconomic and monetary system. It must recognize it has a failed currency and a bankrupt central bank and implement the urgent measures required as quickly as possible. It will be difficult but not impossible, and the potential of the economy is enormous.

Argentina was a rich country made poor by socialism. It needs to abandon socialism to become rich again.

The United States recovered 4.8 million jobs in June, adding to May’s 2.5 million jobs rebound. The United States employment recovery is faster and stronger than the Eurozone one, which has over 40 million workers on subsidized jobless schemes added to a 7.4% unemployment that is expected to rise to 11% by September.

However, the positive headlines show important weaknesses that will have to be addressed in the following months. Labor Department data showed that in the week ending 27 June, initial claims for unemployment fell only slightly, to 1.43 million, on the previous week. Additionally, continuing claims remained stubbornly high at 19.29 million and the share of those reporting permanent job losses increased by 588 thousand.

Considering these factors, the trend shows that the United States unemployment rate would fall to 8.5% with a labor force participation rate of 63% at the end of 2020, according to my estimates. Goldman Sachs has improved its unemployment rate outlook to 9% for 2020 from 9.5% a month ago. However, at this rate the United States would only recover the 2019 record-low unemployment at the end of 2021. Still, much faster than the eurozone.

Subsidized jobless schemes, as the eurozone economies are implementing, is costly and generates extraordinarily little impact on consumption. Government spending is rising at the fastest pace in decades to include the increase in healthcare costs, the jobless insurance expenses, and the subsidised jobless programs. However, workers under these schemes know that their positions are at risk and are deciding, wisely, to save as much as they can. Almost 10% of the labor force in the major European economies is under one of these schemes, designed to help businesses navigate the crisis without letting go of employees.

The World Labor Organization estimates that 400 million full-time jobs have been lost in this crisis. Recovering and strengthening the labor market is crucial for developed economies to achieve the estimates of gross domestic product growth expected in 2021 and 2022. Without a strong job market, consumption and growth are likely to stall in 2021, and it will be exceedingly difficult to see investment growth.

How can economies recover the lost employment and continue to create jobs? Unfortunately, many governments would have to do the opposite of what most developed economies are doing. They should stop bailing out zombie firms, as those already had overcapacity in the past five years and are not going to hire more workers soon. Governments should also reduce unnecessary spending to prevent deficits from rising to unmanageable levels and then increase taxes that would reduce investment and job creation. Bloated public budgets are not going to bring employment back. It did not work in the eurozone in the 2009-2012 period and it will not work elsewhere.

The United States government has taken a more effective approach by combining some demand-side measures with more efficient supply-side policies that have supported the job recovery, even if it is still weak. There is a long and painful road ahead, and the rising number of covid-19 cases may harm the economic recovery as lockdown risks return.

Some commentators in Europe have argued that the job recovery in the United States is stronger due to a larger fiscal and monetary stimulus. It could not be further from the truth. The European Central Bank balance sheet is now 52.8% of GDP, 6.2 trillion euro. It started the year at 39.4%, or 4.6 trillion euro. The Federal Reserve balance sheet is 32.6% of GDP. Fiscal stimulus is also much smaller than in eurozone economies. The US fiscal impulse is equivalent to 5.2% of GDP, compared to 38% in Germany, 30% in Italy, 23% in France, and 10% in Spain.

The reason why the US economy is improving faster than the eurozone is a more dynamic and flexible labor market with more resilient businesses. That does not take away the important challenges of the US. It lost 7.9 million jobs in hospitality and leisure, according to the Bureau of Labor Statistics, and the service sector, which saw the biggest employment reductions, is coming back slowly.

If the United States wants to surprise the world with a much quicker return to record employment it needs to address the permanent job loss figure with tax incentives to hire faster and the continuing jobless claims with a robust and effective set of policies that strengthen business creation and allows existing ones to grow, particularly in digitalization and added-value online services for global customers.

At the current pace, the eurozone will not return to the 2019 employment levels until 2023. In the case of the United States, at the end of 2021 or first quarter of 2022. It is not enough. The global economy may fall back into a recession if the conditions for the labor market and business creation to strengthen are not introduced rapidly.

Governments will have t liberalize the labor market, cut red tape, eliminate harmful overregulation and provide a stable and helpful framework for businesses to start and grow, or they will find themselves in a deeper crisis than feared.

Outlook for 2020 and 2021.

Gold and copper.

Equities and bonds.

If we look at the recovery so far in the majority of economies it is quite less exciting than what many expected, so what we can certainly rule out is the concept of a V-shaped recovery. I think it’s also very uneven. We see that the recovery is quite rapid in those areas that have to do with government spending and weaker in those areas that have to do with travel and leisure. Considering the outlook for 2021, what we believe is that there will be more of an L-shaped type of recovery.

The measures implemented by governments in the Eurozone have one common denominator: A massive increase in debt from governments and the private sector. Loans lead the stimulus packages from Germany to Spain. The objective is to give firms and families some leverage to pass the bad months of the confinement and allow the economy to recover strongly in the third and fourth quarter. This bet on a speedy recovery may put the troubled European banking sector in a difficult situation. Read More