Many commentators state that the United States’ intervention in Venezuela is all about oil. However, they seem to ignore the reality of what has happened in the country.

The current system has been one of squandering and stealing oil for decades.

Venezuela’s oil sector, once the most efficient in the industry, has been systematically looted and weaponised by the socialist Chavez-Maduro regime and its political allies, turning the world’s largest proven reserves into a poverty machine instead of a development engine.

Any serious recovery will require dismantling this network of political exploitation, restoring the rule of law, recapitalising PDVSA, and orienting exports in transparent market conditions.

From an oil superpower to a poverty machine

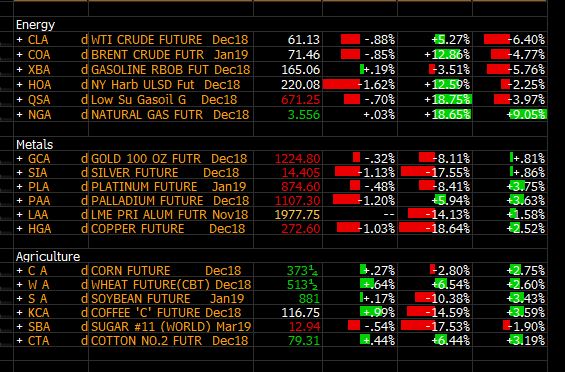

Venezuela went from being one of OPEC’s most efficient producers, reaching more than 3.5 million barrels per day, to a marginal supplier pumping barely 1 million barrels per day.

Despite holding around 20 per cent of global proven crude reserves, production is now less than one per cent of global output, with a collapse in investment, technology, and destructive governance.

Venezuela’s GDP is still below pre‑Chavez levels from more than 26 years ago

The socialist regime has squandered an estimated 300 billion dollars in oil income on clientelism, ideological projects, and opaque foreign deals that left no productive legacy at home.

Leaders of the dictatorship became extremely wealthy while the country was demolished with a clear objective: create a dependent and scared society.

Venezuela’s GDP is still below pre‑Chavez levels from more than 26 years ago; most of the country lives in poverty (90% poverty, 76% extreme poverty) and is suffering one of the largest refugee crises in the world, with 8 million exiled.

The first looter: Chavismo and PDVSA

The biggest thief of Venezuelan wealth has been its own dictatorial regime.

PDVSA was transformed from a technically valued company into a politicised cash machine, purged of more than 18,000 qualified professionals in 2003 and turned “red from top to bottom” to finance the Bolivarian project, according to ex-minister Rafael Ramirez.

Recent scandals alone uncovered tens of billions more lost through black‑market sales, crypto schemes, and uncollected receivables from intermediaries

Transparency Venezuela and other sources point to at least 42 billion dollars stolen in PDVSA‑related corruption schemesabroad, while the ex-planning minister estimates more than 300 billion dollars in misused or diverted oil income since 1999.

Recent scandals alone uncovered tens of billions more lost through black‑market sales, crypto schemes, and uncollected receivables from intermediaries, according to Credit Suisse.

External allies as extractive partners

The current propaganda says that “the United States just wants Venezuelan oil.” This message deliberately hides who is taking the country’s oil for free or on favourable and opaque terms

Recently, around 80 per cent of Venezuela’s exports have gone to China, largely as repayment for tens of billions in oil‑for‑loan deals that mortgage future production and leave no real net income in Caracas.

The Cuban dictatorship has received up to 115,000 barrels per day of oil for free, even as Venezuelans endured gasoline and power shortages.

Russian and Chinese companies have built up significant reserves and control over logistics in joint ventures

The regime exported security agents and repression experts, while Havana then re‑exported part of that crude oil and products, keeping the US dollars that never reached Venezuelan public services.

The Iranian regime has used barter arrangements—gasoline, spare parts, and repression “expertise” in exchange for crude and gold—all in structures designed to sustain the regime rather than the Venezuelan economy.

Russian and Chinese companies have built up significant reserves and control over logistics in joint ventures that were set up without clear rules or fair competition.

Corruption, subsidies, and the fiction of a blockade

The Maduro dictatorship often uses the narrative of a US “blockade” to disguise two facts: first, Venezuela maintains commercial relations with all major economies, and the US is one of its main trading partners; second, US measures have been explicitly linked to democratic conditionality rather than resource seizure.

Venezuela is, additionally, one of the most subsidised economies in the world, receiving tens of billions of dollars of support from Russia and China.

Furthermore, the Venezuelan economy was already collapsing before any sanctions were implemented.

The regime itself used sanctions as an excuse to deepen black‑market operations and discretionary deals that enriched the dictatorship leaders while depleting and decapitalising PDVSA.

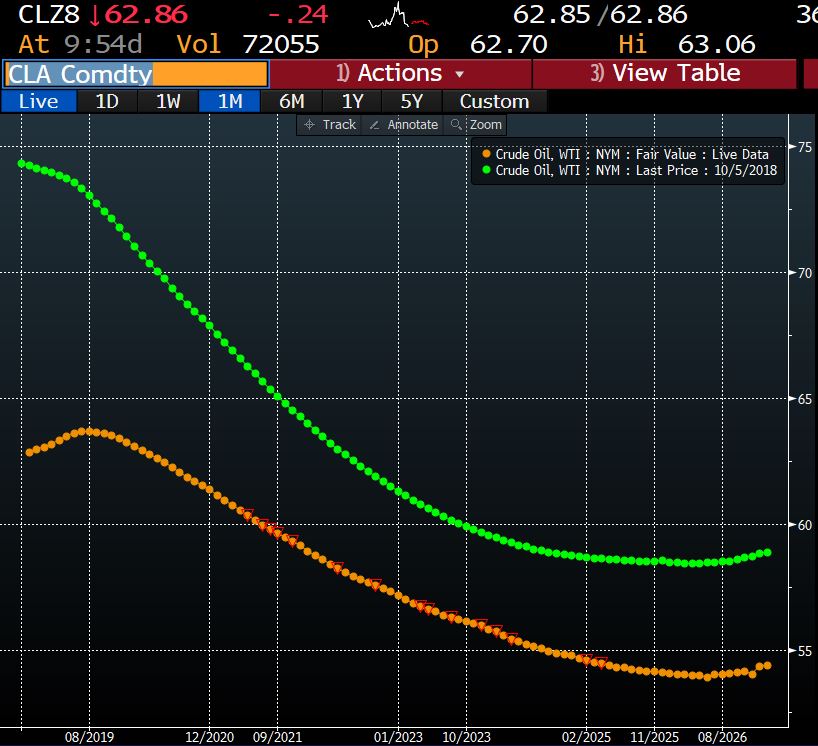

The United States is currently the world’s largest oil producer, at 13.8 million barrels per day

According to reports from Infobae, Maduro and his family have accumulated more than 3.8 billion dollars in offshore accounts. The Swiss government has ordered the freezing of all the family accounts in the country.

The claim that Washington needs Venezuelan heavy crude to avoid an energy crisis is simply nonsense.

The United States is currently the world’s largest oil producer, at 13.8 million barrels per day, and is effectively energy independent while still importing and exporting different grades for refining optimisation and trading.

US refiners can source heavy oil from multiple stable suppliers, including Canada, Mexico, Saudi Arabia, the Emirates, Kuwait, and others.

The preconditions for restoring Venezuela’s oil sector

Restoring Venezuela’s oil sector is technically and financially possible but will take years and at least 100 billion dollars in investment.

In the short term, rehabilitating existing fields and infrastructure could raise production to 2 million barrels per day. In the medium term, developing new projects in the Orinoco Belt would require substantial capital injections.

To recover Venezuela’s oil sector and benefit citizens, four conditions need to be met:

Recovering property rights, legal security, and independent institutions so that PDVSA stops being a political arm and recovers its status as a professional operator.

Auditing and restructuring PDVSA’s debt and those opaque oil‑for‑loan contracts is essential to recover future production from illegitimate commitments.

Opening the sector to credible international firms from Europe and the US with transparent contracts, arbitration mechanisms, and clear fiscal frameworks that maximise net revenue to the Venezuelan state and citizens.

This will benefit Chinese and Russian companies as well, as they have lost billions in the country.

Redirecting oil income from ideological spending and foreign clientelism towards stabilisation, infrastructure, social services, and healthcare.

Venezuela only has two options: maintaining a narco-dictatorship where Cuba, Iran, China, Russia, and the regime elite extract rent from oil wealth and a starving nation, or recovering an open, rules‑based framework in which Venezuela’s oil finally serves its people instead of their political leaders and foreign supporters.